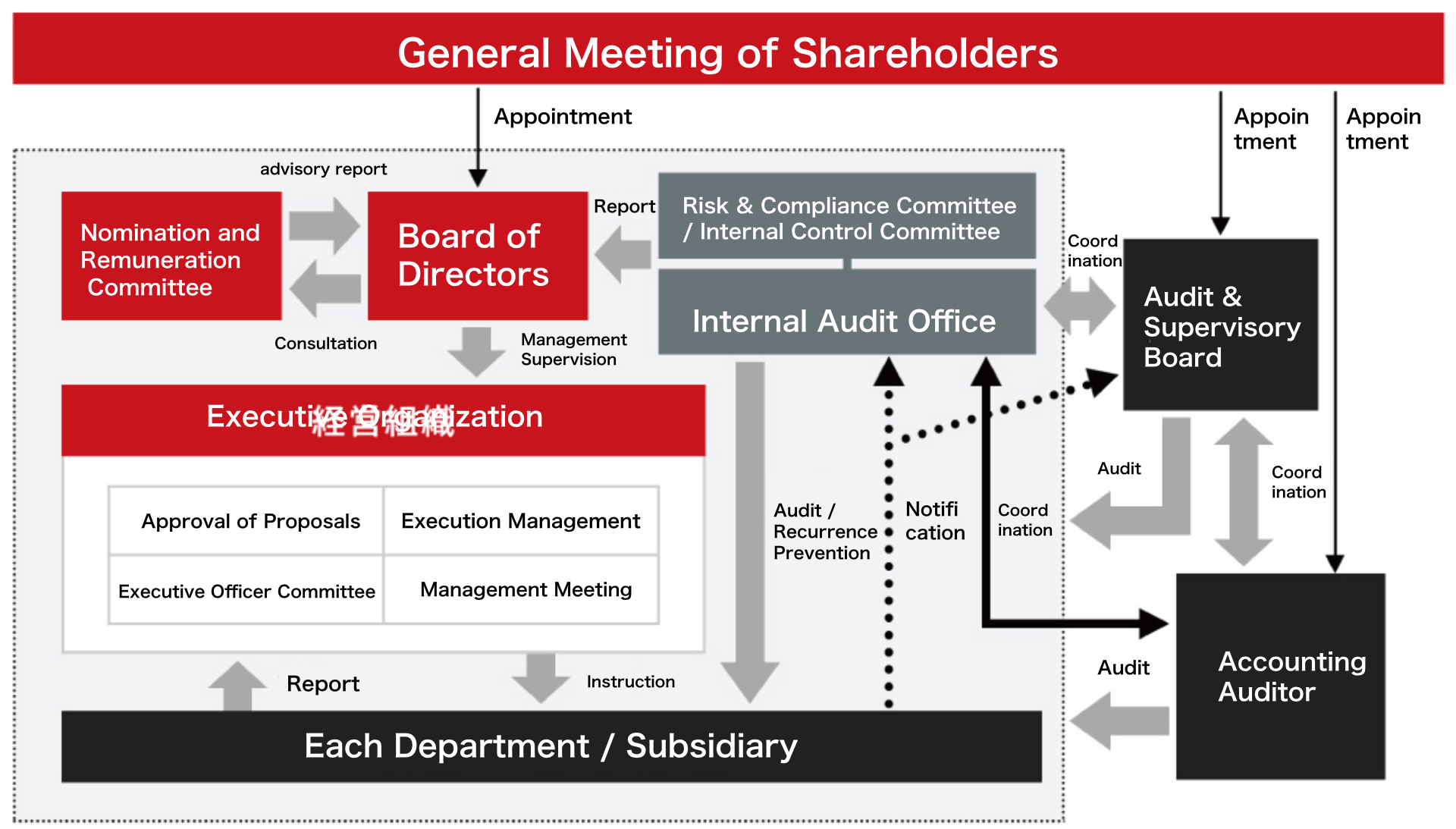

We believe that accelerating management decision-making and smoothly executing business initiatives, while ensuring transparency throughout the process and eliminating illegal activities through mutual checks and balances, are essential elements of corporate governance.

To earn the trust of shareholders, investors, and other stakeholders, we believe that a dual structure is both effective and efficient. This consists of:

● strategic and prompt decision-making and oversight by the Board of Directors, which is well-versed in the challenges faced by both the automotive parts manufacturing industry and our company, and

● supervision and auditing by external directors and external auditors.

For this reason, we consider the structure of a company with an Audit & Supervisory Board to be appropriate. Under this framework, we will continue to strengthen our corporate governance.

Our Board of Directors consists of five directors. In addition to regular monthly meetings, extraordinary meetings are held as needed to deliberate and make decisions on important business operations. The Board also supervises the execution of duties by the Representative Director and Executive Directors through reports on the status of their activities.

Audit & Supervisory Board Members attend Board meetings and provide opinions as necessary.

To strengthen the function of the Board of Directors and ensure oversight from an independent standpoint, we have appointed two Outside Directors. These Outside Directors provide valuable suggestions and advice based on their independent perspective, extensive management experience, and broad knowledge and insight.

Number of meetings held in FY2023: 20

To enhance the fairness, transparency, objectivity, and accountability of the Board of Directors in matters related to director nominations and compensation, we have voluntarily established a Nomination and Remuneration Committee. The committee is convened as necessary.

The committee consists of four directors, including two Outside Directors, with the Chairperson and the majority of members being independent Outside Directors.

The committee discusses matters such as proposals regarding the appointment and dismissal of directors, the compensation system for directors, and performance evaluations.

To earn and maintain the trust of shareholders and investors, our company has adopted an Audit & Supervisory Board system. We believe that this system—combining swift and strategic decision-making and oversight by the Board of Directors, who are well-versed in both the automotive parts manufacturing industry and our company’s management challenges, with supervision and auditing by Outside Directors and Outside Audit & Supervisory Board Members—is both effective and efficient.

The Audit & Supervisory Board consists of three members: one full-time member and two part-time members, all of whom are Outside Audit & Supervisory Board Members.

Each of the three members qualifies as an independent officer as defined by the Tokyo Stock Exchange.

They do more than simply audit legal compliance; acting from an independent and objective standpoint, they actively and assertively exercise their authority, ensuring a structure that enables proper judgment and action.

Our company has entrusted its accounting audit operations to KPMG AZSA LLC. The Accounting Auditor maintains close coordination with the Audit & Supervisory Board, providing reports on audit plans and results, and conducting necessary information and opinion exchanges throughout the fiscal year. These efforts aim to ensure audits are carried out both efficiently and effectively.

The Executive Officers’ Committee consists of nine executive officers, including those who concurrently serve as directors. The committee deliberates and makes decisions on specific management issues related to business execution.

The Management Meeting is convened as necessary and consists of directors (excluding outside directors) and the presidents of each subsidiary. The meeting receives reports on the business plans and operational status of both domestic and overseas subsidiaries, enabling top management to monitor and follow up on business execution.

Under the activity slogan “Challenge to the Future,” our company is promoting the 15th Medium-Term Management Plan.

This plan sets forth the key theme of “rebuilding a management foundation that ensures sustainable profitability.”

To achieve this goal, we have established a system that enables prompt and objective decision-making on management issues from various perspectives. Accordingly, we appoint directors and auditors with consideration for diversity, including gender and international experience.

●External ●Newly appointed

| Director | Auditor | |||||||

| Kaoru Ogata | Xu Wei Ding | Masato Kobayashi ● |

Yuko Chiyoda ● |

Keiichi Murata ● |

Hideo Takezoe ●● |

Keiichi Otsuka ● |

Hisashi Inagaki ● |

|

| Board Attendance (FY2023) | 20/20 | 20/20 | - | 20/20 | 20/20 | - | 20/20 | 15/15 |

| Nomination & Compensation Committee Attendance (FY2023) | 7/7 | 1/1 | - | 7/7 | 7/7 | - | - | - |

| Possessed Skills | ||||||||

| CorporateManagement | ● | ○ | ● | ○ | ||||

| Finance/ Accounting | ○ | ○ | ● | ○ | ||||

| Compliance | ● | ○ | ● | ○ | ● | |||

| ESG | ○ | ○ | ○ | |||||

| HR /Labor | ○ | ○ | ||||||

| Tech Development | ● | ○ | ||||||

| Sales | ○ | ○ | ○ | ○ | ||||

| International Experience | ○ | ● | ○ | |||||

| Chairmanship / Notes | Chair of Board of Directors, Executive Officers Meeting, and Management Meeting | Chair of Nomination & Compensation Committee | Chair of Audit & Supervisory Board | |||||

Notes:

(Note 1) ●indicates skills especially expected of each member.

(Note 2) The listed skills do not encompass all of each individual's knowledge and experience, but rather highlight the key items deemed necessary to achieve the company’s management policies and the 15th Medium-Term Management Plan.

To contribute to the enhancement of medium- to long-term corporate value, the Company evaluates the effectiveness of its Board of Directors by verifying the performance of governance, business progress, and other factors from the perspectives of both executive directors and outside directors. The results of the effectiveness evaluation of the Board of Directors for fiscal year 2023 are as follows.

| Respondents: | All Directors and Audit & Supervisory Board Members as of the end of March 2024 (5 Directors and 3 Audit & Supervisory Board Members) |

|---|---|

| Format: | Named questionnaire |

| Question Topics: | 1. Effectiveness Evaluation of Overall Management ① Securing the rights and equality of shareholders ② Appropriate collaboration with stakeholders other than shareholders ③ Ensuring proper information disclosure and transparency ④ Responsibilities of the Board of Directors, etc. ⑤ Dialogue with shareholders 2. Effectiveness Evaluation of the Board of Directors ⑥ Appropriateness of the board size and composition ⑦ Quality of the decision-making process of the Board ⑧ Quality of information provided to the Board |

| Effectiveness Evaluation of the Board of Director | March 2024 |

(1) Overview

Based on the results of the aforementioned questionnaire, the effectiveness of our Board of Directors was generally assessed to be appropriately maintained. Compared to the previous year, improvements were confirmed in the overall total of the items listed in the above table.

However, some items still show room for improvement. We recognize that these issues require continued examination and improvement on a regular basis moving forward.

(2) Items Showing Improvement

- Regarding the Board’s efforts on overall management:

- Information disclosure to stakeholders, including timing, is being conducted appropriately.

- Improvements were seen in the planning of human resource development, including the establishment of a succession plan.

- Regarding the effectiveness of the Board of Directors:

- The number of directors, diversity, and the composition of internal and external members are generally appropriate.

(3) Items Needing Improvement

- Regarding the Board’s efforts on overall management:

- Implement strategic and planned information disclosure that includes non-financial information contributing to corporate value enhancement.

- Establish human resource development policies and frameworks to ensure consistent and continuous talent development.

- Strengthen mechanisms for conducting PDCA (Plan-Do-Check-Act) cycles aimed at growth strategies and achievement of goals.

- Improve the quality of risk assessment and discussions for each agenda item.

- Regarding the effectiveness of the Board of Directors:

- Enhance the quantity and quality of information provided to outside directors.

Based on these evaluation results, focused deliberations will be conducted on the extracted issues. Priority will be given to items needing improvement, with corresponding measures formulated and implemented. Specifically, meetings will be held among Board members to deepen discussions on management issues from diverse internal and external perspectives. By gathering each director’s views and expertise, improvement plans will be devised and advanced through the PDCA cycle.

Our company will continue to work on enhancing the effectiveness of the Board of Directors to achieve sustainable growth and medium-to long-term enhancement of corporate value.

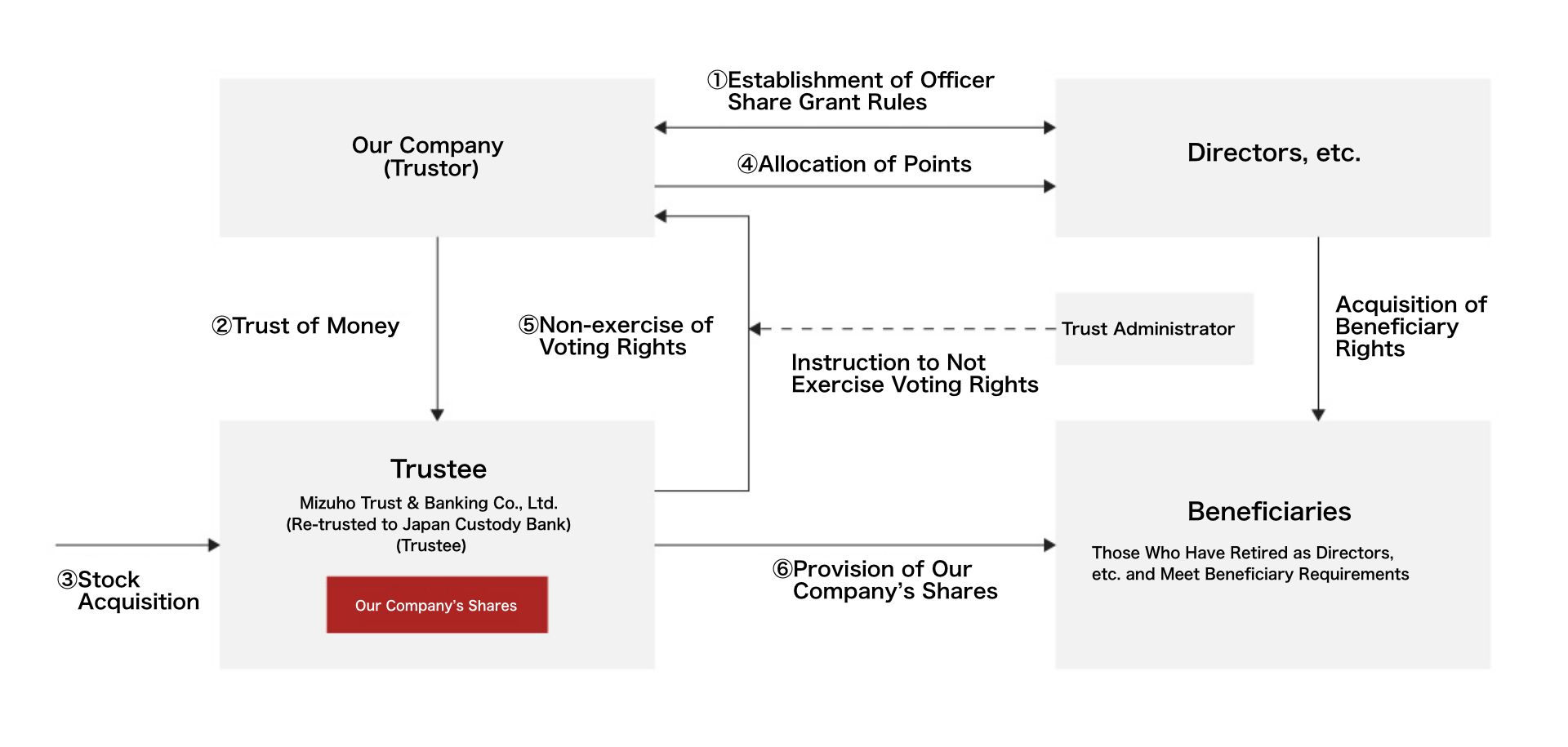

The compensation system for directors is designed to function effectively as an incentive to sustainably enhance corporate value, linking remuneration to shareholder interests. The basic policy is to determine the appropriate level of individual director compensation based on their respective responsibilities.

Compensation for executive directors consists of fixed remuneration (base salary and stock-based compensation) and variable remuneration (performance-linked bonuses and performance-based stock compensation). For outside directors, who serve supervisory functions, fixed remuneration consisting of “base salary” and “stock-based compensation” is provided.

| Base Salary | A fixed monthly compensation determined comprehensively by considering factors such as position, responsibilities, length of service, industry standards, the company’s performance, and employee salary levels. |

|---|---|

| Stock-Based Compensation | Designed to encourage directors to share not only the benefits of stock price appreciation but also the risks of stock price decline with shareholders, thereby fostering awareness that contributes to mid- to long-term performance improvement and corporate value enhancement. Points are granted for each fiscal year based on the Officer Stock Grant Regulations, which are approved by the Board of Directors. |

| Performance-Linked Bonuses | Calculated by comprehensively evaluating the performance during the assessment period, position, and results of directors (excluding outside directors). The bonus amount is based on the achievement level against the consolidated operating profit target for each fiscal year and is paid at a specified time. |

| Performance-Based Stock Compensation | This system evaluates performance from two perspectives: the short-term business plan (STBP) performance evaluation coefficient and the medium-term business plan (MTBP) performance evaluation coefficient. Points are allocated for each fiscal year by multiplying the achievement rates against the short-term and medium-term targets by the respective weights assigned per position. Calculation method: Points granted = Position points × STBP weight × STBP performance evaluation coefficient + Position points × MTBP weight × MTBP performance evaluation coefficient |

Note 1: STBP refers to the Short-Term Business Plan.

| Executive Category | Total Compensation (Million JPY) | Total Compensation by Type (Million JPY) | Number of Eligible Executives (Persons) | |||

|---|---|---|---|---|---|---|

| Base Salary | Stock-Based Compensation | Performance-Linked Bonus | Performance-Based Stock Compensation | |||

| Directors (of which Outside Directors) | 85(13) | 76(12) | 8(1) | -(-) | -(-) | 7(3) |

| Audit & Supervisory Board Members (of which Outside Audit & Supervisory Board Members) | 23(23) | 23(23) | -(-) | -(-) | -(-) | 4(4) |

Additionally, as part of the performance-based stock compensation, we have introduced a "Stock Grant Trust (BBT※2)."

This system involves the acquisition of our company shares through a trust funded by monetary contributions made by the company. Shares are then granted to directors and others through this trust in accordance with the rules for stock-based compensation established by the company. Generally, the timing for directors and others to receive the shares is upon their retirement from the company.

※2 BBT = Board Benefit Trust

The TBK Group fundamentally commits to appropriate tax filing and payment. We strictly comply with the laws and regulations of each country where we operate, strive to eliminate any arbitrary tax avoidance, and work to optimize our tax burden by utilizing available tax incentives within the scope of legitimate business activities. We maintain transparent communication with domestic and international tax authorities and endeavor to build mutual understanding and trust.

All officers and employees of our Group shall comply with laws, internal regulations, and other rules in the course of their duties. They shall act in accordance with social norms and conduct corporate activities with high transparency.

The TBK Group, under the management philosophy of "Creating products that delight our customers and contribute to society," supports the safety and security of logistics by stably supplying important safety components such as brakes and pumps, which function for engine cooling and lubrication.

In addition to manufacturing utilizing casting and processing technologies cultivated over many years, we are also focusing on the development of electrification solutions for a new era, aiming to be a company that contributes to a recycling-oriented society.

In our business activities, each director and employee acts proactively based on high ethical standards, adhering to their duty of care.

As part of this, we have positioned the prevention of corruption as an important issue and established the following policy based on the “Group Code of Conduct: Basic Compliance Philosophy.”

1.Basic Stance

The TBK Group requires all employees and related parties to comply with high ethical standards and strives to prevent corruption, thereby ensuring fair and sound relationships with all stakeholders.

2.Scope of Application

This policy applies to all directors and employees of the TBK Group (including contract employees, fixed-term contract employees, and dispatched employees).

3.Prohibition of Corrupt Practice

① Bribery

Bribes and improper benefits to domestic and foreign public officials and business partners are strictly prohibited, and fair transactions are promoted.

②Conflict of Interest

Situations where personal interests or relationships affect the company's interests are avoided, and actions are taken with transparency.

③Facilitation Payments

All facilitation payments, including small bribes to expedite administrative procedures, are prohibited.

④Money Laundering

Acts that disguise illegally obtained funds as legitimate are prohibited, and transparency of funds is ensured.

⑤Insider Trading

No trading of stocks or bonds of related business partners, competitors, or customers based on confidential internal information obtained in the course of business before such information is disclosed to the general public. Leaking such information to third parties is also prohibited.

⑥Improper Record Keeping

Creating or keeping false or misleading records is prohibited; accurate and transparent records are maintained.

4.Reporting and Corrective Actions

If corruption occurs or is suspected, reporting through the internal whistleblower system is encouraged promptly. Investigations will be conducted based on reports, and necessary corrective and recurrence prevention measures will be taken to maintain a fair business environment. Retaliation or any disadvantageous treatment against whistleblowers is strictly prohibited.

5.Awareness and Education

The anti-corruption policy is communicated to employees, and regular education is conducted to enhance understanding and awareness.

6.Legal Compliance

Compliance with applicable laws and regulations in each country and region is ensured, and actions are taken accordingly.

This policy has been approved by the Sustainability Committee, a direct body of the Board of Directors, and is signed by the President and CEO.

October 21, 2024

TBK Corporation

President and CEO, Kaoru Ogata

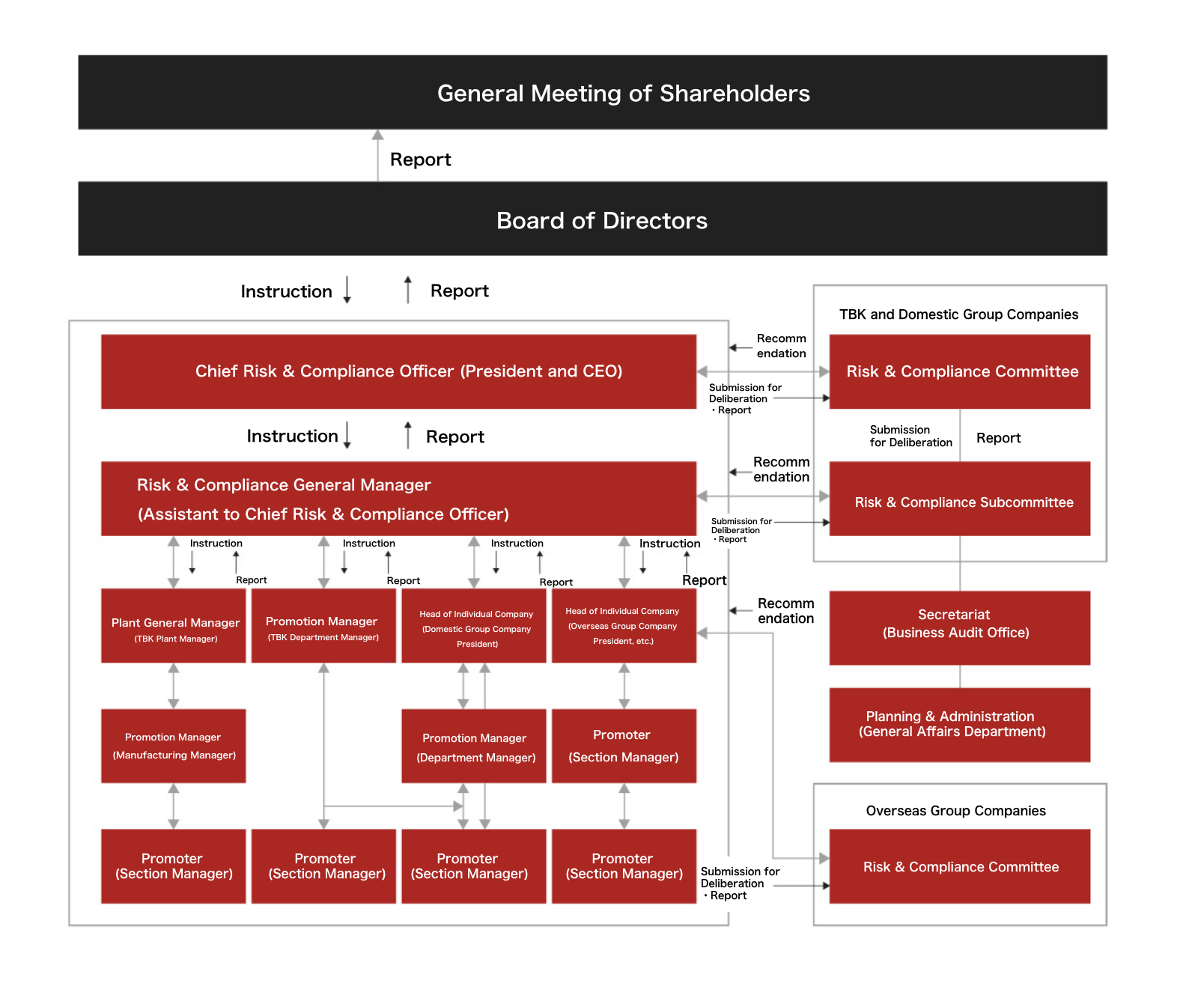

Risk and Compliance Management System

The TBK Group has established a Risk and Compliance Committee, headed by the TBK President as the Chief Executive Officer, and promotes risk management in coordination with each business site. The activities of the Risk and Compliance Committee are regularly reported to the Board of Directors.

Compliance Training

The TBK Group conducts compliance training with the aim that all officers and employees acquire the necessary knowledge to comply with laws, regulations, and social rules, and to contribute to society. Once a year, the training covers themes such

as the prevention of maternity harassment, paternity harassment, sexual harassment, and power harassment.

Internal Whistleblowing System

The TBK Group has established an internal whistleblowing system for its domestic and overseas group companies with the purpose of preventing misconduct such as fraud, facilitating early detection and correction, and thereby strengthening compliance management. This system provides a proper mechanism for handling reports related to organizational or individual violations of laws and regulations within group companies in Japan and overseas. The system is available to employees and others belonging to the TBK Group※, who can report any occurrence of legal violations, breaches of internal regulations, or violations of the Compliance Code of Conduct. Reports can be made anonymously, and after investigating the facts, appropriate action will be taken if problems are confirmed. Through this system, the TBK Group strives to enhance transparency and fairness and to build a trusted corporate culture.

※This includes officers, regular employees, contract employees, part-time workers, temporary employees, quasi-regular employees, other fixed-term employees, dispatched workers, and those who have retired, whose contract has ended, or who have finished dispatch work within one year—excluding retired officers.

Basic Philosophy

Recognizing that "ensuring the accuracy of financial reporting is an essential condition to gain the trust of stakeholders including shareholders and to expand and develop the business," we strive for the continuous improvement of internal controls. To embody this philosophy, we undertake the following:

- Conduct internal control activities to enhance stakeholders’ trust in the financial reporting of the Company Group.

- Effectively utilize the internal control management system to prevent financial fraud and errors, and to continuously improve.

- Comply with laws, regulations, and internal rules related to internal controls.

- Develop and implement action plans based on the internal control policy, carry out concrete deployment, and conduct regular reviews.

The scope of application includes company-wide internal controls, IT general controls, and the following business processes:

Target Business Processes

(1)Sales Process

(2)Purchasing Process

(3)Manufacturing Cost Management Process

(4) Inventory Management Process

(5)Closing and Financial Reporting Process

(6) IT-related Business Processing Controls

Based on the “Basic Policy of the Internal Control System,” our company promotes the establishment of key management foundations such as legal compliance, risk management, information management, and audit systems to realize fair and efficient business operations. Additionally, we continuously review and improve internal controls in response to social demands and changes in laws and regulations, aiming to conduct highly transparent corporate activities and secure trust from stakeholders.

Basic Concept of Information Security

- We protect the information assets we hold from various threats, maintaining their confidentiality, integrity, and availability.

- Each employee shares a common understanding of the importance of information security and ensures that no security issues arise.

- We implement personnel security measures, physical security measures, technical security measures, and operational security measures.

- We strictly comply with relevant laws, regulations, and rules.

Security measures for PCs and servers using tools (EDR*) that detect suspicious behavior within devices Our domestic group has implemented EDR, applying it not only to internal business terminals but also to servers and manufacturing line terminals, thereby strengthening security measures. *EDR: A system designed not to prevent attacks or intrusions on devices but to detect threats that were not prevented.

Network security measures based on Zero Trust Security

To adapt to changes in working styles and system configurations, we operate a SASE (Secure Access Service Edge) platform, an integrated security model, under the concept of “Zero Trust Security,” which verifies the security of all communications.

Unauthorized access prevention measures using multi-factor authentication*

*Multi-factor authentication (MFA) requires users to provide multiple verification factors to gain access, enhancing security.

In our domestic group, multi-factor authentication (MFA) has been implemented for

access to email systems and internal information-sharing systems. This mechanism prevents unauthorized access even if attackers obtain passwords, thereby strengthening the protection of critical information. At the same time, it balances strict authentication with user convenience, providing an environment where employees can use systems with peace of mind.

*By combining passwords with one-time passwords generated on smartphones or biometric authentication, this system significantly reduces the risk of unauthorized access and impersonation.