Always Improving.

Although we recorded positive earnings at all levels for the fiscal year ended March 2024, we recognize that a strong and decisive improvement in overall profitability has yet to be achieved.

Looking at the performance by region, Japan saw a turnaround in operating profit, despite flat sales. This was largely due to the success of fundamental structural reforms, including the integration of our domestic subsidiaries.

On the other hand, in Thailand—where TBK Group had driven growth by supplying products for pickup trucks—automobile sales declined sharply. This was influenced by persistently high policy interest rates and worsening household debt, which led to stricter loan screening practices. While we remained in the black, we cannot describe our earnings there as strong.

In contrast, our performance in India has been relatively strong. We achieved better-than-expected profitability through price increases on existing products and the successful rollout of new ones. Sales have doubled compared to three years ago.

In China, where we had faced ongoing concerns, our business supplying brake linings (friction materials) to Japanese companies returned to profitability. However, our brake business operated through local joint ventures continues to swing between profits and losses. If the situation does not improve, we may have no choice but to consider downsizing.

As for North America, another long-standing challenge, we ended local production in September 2024. Following successful negotiations with our clients, we were able to shift the supply of our main product—water pumps—to India. This decision was based on the recognition of our high quality and proprietary specifications that are difficult for other companies to replicate.

Personally, I was involved in launching our U.S. plant in 2002 and later served as President of TBK America, Inc. for more than three years from 2011, during which time I led efforts to restructure our North American business. Now, as President of TBK, I have continued discussions with customers to pursue fundamental improvements in this area.

Although transferring production to India has resolved the profitability challenges of this business, we take the significance of this relocation seriously.

In this way, I believe that the fiscal year ended March 2024 demonstrated the gradual effects of the initiatives we have pursued since I assumed the role of President in April 2022.

In May 2024, TBK announced a downward revision of its targets under the 15th Medium-Term Management Plan (ending in March 2025), adjusting sales to ¥54.0 billion and operating profit to ¥1.0 billion.

In Japan, the resolution of vehicle manufacturers’ backorders and the end of last-minute demand before model changes led to a slowdown. Overseas, a decline in demand in Thailand and slower-than-expected recovery in the Chinese business are also expected to cause a significant shortfall in sales compared to initial projections. Additionally, for construction equipment, we anticipate sluggish sales as the industry enters a downcycle that recurs every few years.

Alongside reduced profits from lower sales, we recorded special losses in the first quarter of FY2025 due to the shutdown of our U.S. production operations. These included an impairment loss of ¥110 million and a business restructuring cost of ¥195 million.

These special losses are only partially reported, and we will promptly disclose any further impact on consolidated results once confirmed. (This was disclosed in the “Notice Regarding Recognition of Special Loss at a Consolidated Subsidiary and Revision of Consolidated Earnings Forecast” dated November 7, 2024.)

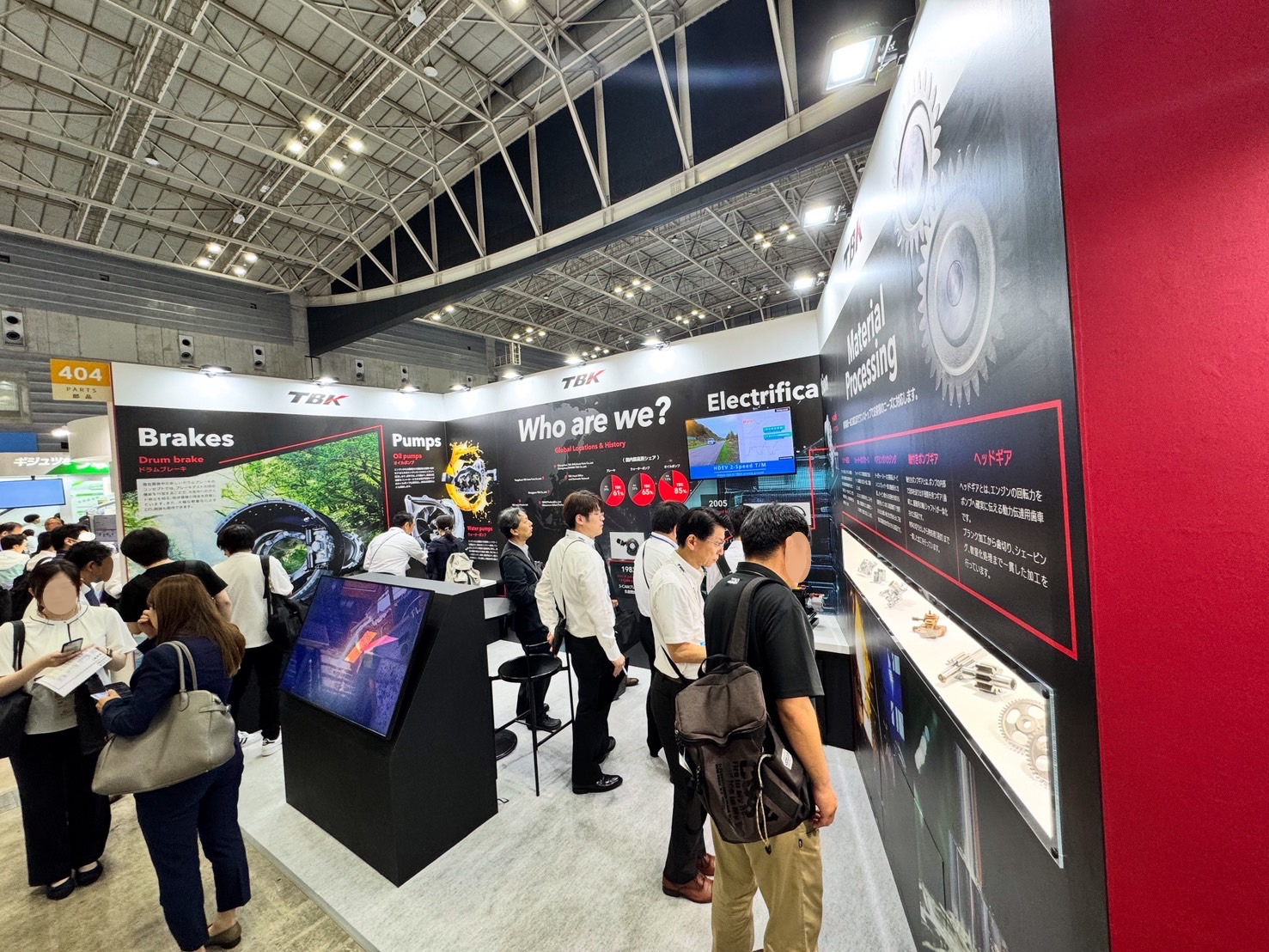

To turn around this situation, I have personally taken the lead in top-level sales efforts and initiated product exhibitions to dispel the stereotype of TBK as merely a “brake and pump company.” By showcasing our strength in handling everything from raw materials to machining and assembly, we are successfully securing orders for new products we had not previously handled.

One focus of our “Challenge to New Business Domains,” as stated in the medium-term plan, is the early success of gravity die casting operations in Thailand. While we manufacture precision auto parts, the persistently high defect rate has delayed profitability. As I was directly involved in launching this business during my assignment in Thailand, I have revisited the site in person to drive improvements.

Looking ahead, we plan to replicate the approach used in Thailand—bringing die production in-house—and expand gravity casting operations in Japan as well.

Meanwhile, in Thailand, we had announced plans to introduce a large aluminum die-casting machine. However, due to lower-than-expected electrification of commercial vehicles, the introduction has been postponed by approximately one year. Equipment selection is already complete, and we will make the investment at the appropriate time.

Progress is being made in other areas, such as production line integration and automation through robotics. In Japan, we are building systems that visualize production line operations at a glance, accelerating integration efforts.

In China, robots can be introduced at lower cost, enabling some factories to reduce manpower by dozens of workers. In India, robotic automation is also delivering results with the installation of new lines.

In fact, automation and robotization are advancing more quickly overseas than in Japan. We are now considering similar measures domestically.

To globally share such initiatives and improvements, we are also exploring company-wide quality improvement activities such as QC circles and in-house presentation events.

We believe that the current business stagnation is due to TBK remaining reliant on conventional management and manufacturing approaches, and being slow to adapt in a market with limited competition.

As set forth in our "VISION 2030" action principles—“Do now. Do new. Run fast.”

—we must constantly move forward and pursue improvements without pause.

To foster a culture of continuous improvement, we will promote organizational awareness reforms and enhance our HR systems to recognize and reward motivated employees.

As for our "ESG Management Initiatives" in the medium-term plan, we achieved our target for FY2024 by reducing CO₂ emissions by 29.4% compared to FY2013 levels—exceeding the goal of 15%. This success is largely attributed to the installation of solar power systems at sites in Thailand, India, and Japan. For example, at the Fukushima Plant, we are installing solar panels over parking areas to promote decarbonization through the use of renewable energy.

We are also actively reducing material costs by recovering metal chips generated during casting processes and reusing them in new castings, helping to control cost increases.

We anticipate that the electrification of commercial vehicles will begin contributing meaningfully to our earnings around 2027–2028, with a gradual shift toward electrification starting around 2030. However, we expect the market to split into roughly three segments: one-third battery electric vehicles (EVs), one-third fuel cell vehicles (FCVs), and the remaining third consisting of combinations with eco-fuels.

It appears that even vehicle manufacturers are still uncertain about how to proceed with the electrification of commercial vehicles.

Currently, commercial EVs are expensive, and unless they are operated with extremely high efficiency, they are unlikely to deliver significant financial returns.

In Europe, it is said that trucks can travel up to 800 kilometers per day. As such, running cost issues—such as battery degradation over time—along with concerns about charging times and usability in cold climates, are expected to shape the type of commercial EVs that will be required in the future.

Regardless of which direction the commercial vehicle market takes, TBK is committed to maintaining capabilities in both electrification and internal combustion engine (ICE) technologies, so that we are never in a position to tell our customers, “That’s not possible.”

In sectors such as trucks, construction machinery, and agricultural equipment, we expect ICEs to remain in use. Accordingly, we will continue to develop solutions on both fronts to remain agile in the face of change.